The core change within the fashion industry has to be from the route of the supply chain to the end consumer. As well as becoming leaner and more digital, fashion needs to become more circular. Most brand’s buy their collections assuming they will have 20-30 per cent waste at the end of the season. If a brand wants to sell 100 units, they will buy 130 units and figure the excess into their margin and bottom-line. As Vogue Business said, “Circularity is still a nascent business model for the fashion industry, though it’s emerging as a greater priority as brands look to drastically reduce carbon emissions and waste and using new sources”.

The Circular Fashion Summit by Lablaco in partnership with Vogue Business, PwC, Anthesis, Startupbootcamp and other leading organisations created a circular fashion report 2020 with a goal to provide unique insights on the new digitalised circular economy. Susan Harris, Technical Director for Anthesis explains, “Circular fashion is about moving away from a linear model of “take, make, dispose” and moving towards a new, regenerative model that can help us meet the UN Sustainable Development goals and revolutionise our consumption and production patterns to achieve a more sustainable world”.

The difference between the Circular Fashion Industry and Linear fashion is explained here by the Ellen McArthur Foundation: “In a Circular economy, waste and pollution are designed out: products and materials are kept in use and made from safe and recycled or renewable inputs”. The standard linear business model ‘takes- makes and wastes”, it causes pollution, it’s resource intense and creates untold waste. Today’s linear model also has a negative impact on the environment and people. The textile industry mainly relies on un-renewable sources, it takes 98 million tons a year including oil to manufacture synthetics fibres, fertilisers to grow cotton and chemicals to produce, dye and finish fibres and textiles.

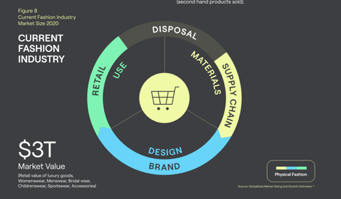

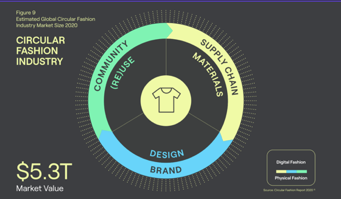

The Circular Fashion Summit have forecasted that if the fashion industry can reduce this waste then the current fashion market value which is $3 Trillion could increase to $5.3 Trillion.

HOW DO WE DO THIS?

DESIGN

The beginning of the fashion cycle starts with design, so it’s here that “conscious designing” can impact the sustainability of the garment. Part of the issues the industry faces with recycling is that garments are not designed to last and many of the fabrics are mixed fibres which are difficult to break down into new yarns within recycling plants. Designing consciously means that the designer considers how they can eliminate waste, how they can improve water efficiency and how they can use non-toxic, sustainable and recycled materials & trims and be energy efficient.

In terms of sustainable fabrics, there are now good alternatives to animal products. Start-ups like Modern Meadow are creating lab-grown leather and companies like Bolt Threads and Ontogenetic are innovating super-strong spider silk.

Moving from traditional cotton to organic cotton reduces water consumption by 91 per cent. There are now many plant based and biodegradable options to choose from such as tencel, modal, linen, bamboo as well as yarns made from pineapples and bananas that it should be much easier for brands to incorporate within their design process. There are also many recycled nylons and polyesters available, one of the best is Econyl, a regenerated nylon which was introduced in 2011 by Aquafil. It is made entirely from ocean and landfill waste, such as industrial plastic old carpets and “ghost nets” and it’s end uses are endless, swimwear, leggings, tights and form fitting garments are being made by this unique fibre.

One designer embracing circularity to its fullest degree is Bethany Williams. The British designer is best known for upcycling waste fabrics into lively, collaged garments, but she puts the dignity of marginalised families and workers at its centre. Bethany says that her business has grown 74 per cent since June 2019, despite the pandemic. In February, Williams released a capsule collection of coats made from upcycled blankets, sold exclusively at Selfridges from £1,380. Myhr says it resonated well with consumers, achieving an above-average sell-through rate of 75 per cent at full price in the midst of the pandemic. “Scaling up is the next step,” she adds.

REUSE & RECYLE OF GARMENTS

Reusing and recycling garments is a key area to start reducing some of the waste that’s being produced. According to the Lablaco report, an estimated $500 billion is lost every year due to clothing being barely worn and rarely recycled.

Circularity experts say that if the life span of a product is increased by an extra 9 months, then it reduces the environmental impact by 20-30%.

Even before the pandemic arrived, there had been an upsurge in online second-hand and consignment platforms. In 2019, this market expanded 21 times faster than conventional apparel commerce with the pandemic just accelerating the growth even further. According to a recent report by ThredUp, the U.S. second-hand fashion market is expected to more than triple in value in the next 10 years – from $28 billion in 2019 to $80 billion in 2030, with fast fashion predicted to be worth about $40 billion. Early signs of this could be seen in ThredUp Inc, who filed for an IPO and Vestiaire Collective, their European rival, raised $64.2 million in fresh funding (Forbes).

This data also suggests that the second-hand fashion market is growing at a faster rate than sustainable fashion. Thredup quoted that 118 million consumers have tried reselling for the first time in 2021, compared with just 36.2 million first-time sellers in 2020 (Bazaar).

The scope of offerings is now diverse. For the Fashion-conscious Gen Zen, Depop and Vintage have been their go to sales channels for several years, so much so that Depop was just bought by Etsy for over £1.1 billion. Etsy said the acquisition would help capture the ever-expanding second-hand clothing sector and increase its penetration among ‘Generation Z’ consumers. It noted that Depop is the tenth most visited shopping website among people under 26 years old, who also comprise around 90 per cent of its active users and tend to be more environmentally conscious about their fashion choices.

What makes a platform like Depop so unique is the intrinsic link with followers on YouTube and Tiktok, “Thrift haul” videos create an opportunity for anyone to buy or adapt a second hand garment and re-sell it, creating an environment for unique fashion. If you click on “thrift haul” videos on TikTok, this hashtag has nearly 1 billion views, considering that TikTok has 1 billion users, this implies that the engagement in TikTok with second-hand clothes is high. Other second-hand online sites that are thriving include therealreal.com, cudoni.com, ekcluxury.com, designerexchange.com, but these websites are still very much aimed at higher end fashion, not fast fashion.

There are also many new opportunities for other groups less driven by online and who prefer to shop in stores. Large retail outlets such as Galleries Lafayette have opened thrift stores within the department store. Le(Re)Store is a 500-square-metre permanent space dedicated entirely to circular fashion — in no less a location than its iconic Paris flagship on Boulevard Haussman. Other UK retailers are following suit, Asda announced in April 2021, that they are testing out second-hand clothing in 50 supermarkets and John Lewis and Ikea are launching schemes to sell used furniture and fashion.

In addition to a booming re-sale market, the rental market is growing. Rotaro.co.uk and mywardrobehq.com are just two companies where you can rent a garment from your favourite designer, for a limited period of time for a very reasonable cost. To go that one step further and take it from online to retail, Mywardrobehq.com has partnered with Fashion Re-told, a luxury pop-up store within Harrods that has raised funds for a UK charity through sales of second-hand items. Fashion Re-told has also partnered with The Restory, a repair company, primarily invested in repairing luxury shoes, bags and leather accessories.

Luxury brands are also getting in on the trend, with Jean Paul Gaultier announcing last week that they will soon be renting out their extensive archive for customers to borrow, whilst it will be launching a resale arm on its website, where it will sell vintage pieces.

One of the main challenges of the rental market will be how it is able to scale itself. Rent the Runway, one of the first luxury US rental companies, have seen their shares fallen since their IPO last week from $23 to $16.85 today. Investors are concerned over the relatively small user base of 112,000 subscribers who are mainly based around NYC.

I would love to know your thoughts on circularity, second-hand clothes and the rental market and to hear about other brands that are doing amazing things within this sector.